Louwrens Koen Attorneys • Est. 2010

Getting Married?

Protect What Matters.

Register your antenuptial contract online.

Drafted by an Notary Public and registered at the Deeds Office — all-inclusive.

Your choices before getting married - different antenuptial contracts compared

Explore your matrimonial property regime options before getting married. You must choose one before getting married. Your choice will have financial and legal consequences. You are therefore urged to carefully consider your options. If you still have questions, you are welcome to contact us. Get Started - Explore your options.

Frequently Asked Questions

Top 5 questions — View all FAQs → See Main Menu

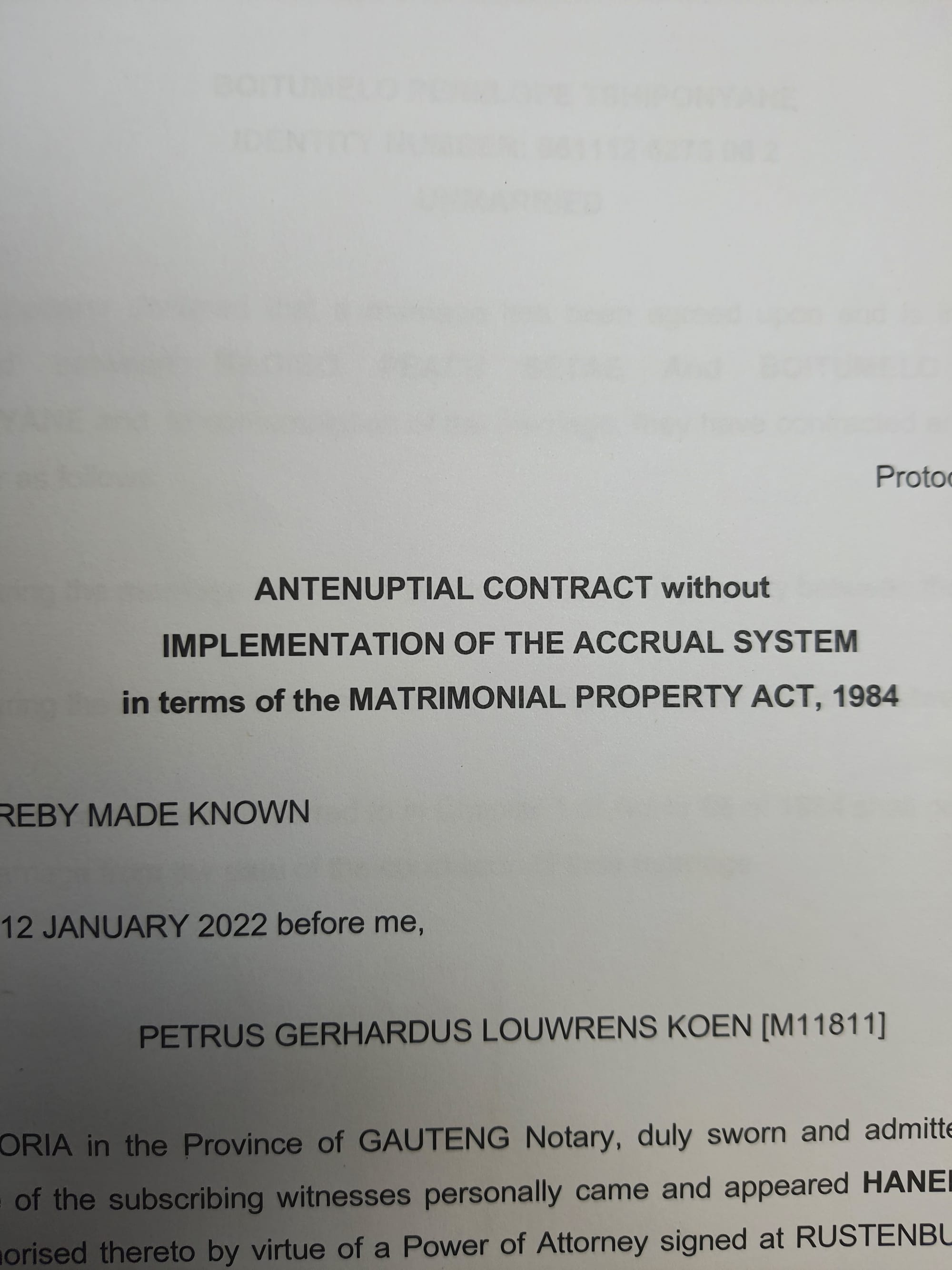

What is an Antenuptial Contract?

An Antenuptial Contract is a legal agreement signed before marriage that determines your matrimonial property regime. It prevents your estates from merging into a single "Joint Estate," protecting you from your partner's pre-existing debts.

How much does it cost?

We charge an all-inclusive fee of R1,950 to draft and register your Antenuptial Contract. This includes drafting, notarial execution, and registration at the Deeds Office. No hidden costs.

How long does it take?

This is one of the places you can use for adding FAQ answers on your website. You can edit all of this text and replace it with anything you want to answer for your client. Edit your FAQ page from the Pages tab by clicking the edit button.

Do we have to wait for registration before we marry?

No. Once you sign the contract at our office, our Notary Public issues a special certificate for your marriage officer. This certificate allows the wedding to proceed immediately while we handle the formal registration.

Why should we consider an antenuptial contract?

Important reasons to sign a prenuptial agreement before walking down the aisle.

- You are Marrying Someone with Significant Debt.

- You Wish to Protect Your Assets.

- You Want to Ensure Financial Security for Both Parties.

- You Want to Protect Your Business.

- Both parties need financial freedom to trade.

Get in Touch

Louwrens Koen Attorneys have assisted thousands of couples. We pride ourselves on being approachable — don't hesitate to contact us.

- Louwrens Koen Attorneys 417 Kirkness Street, Sunnyside, Pretoria, South Africa

- Northern Pavilion, Gate 12, Floor 2, Office 4

- +27-0870010733

- admin@louwrens-koen.co.za

- Mon - Thurs: 8 am - 16h30 pm Fri: 8 am - 16h00 pm Sat - Sun: Closed