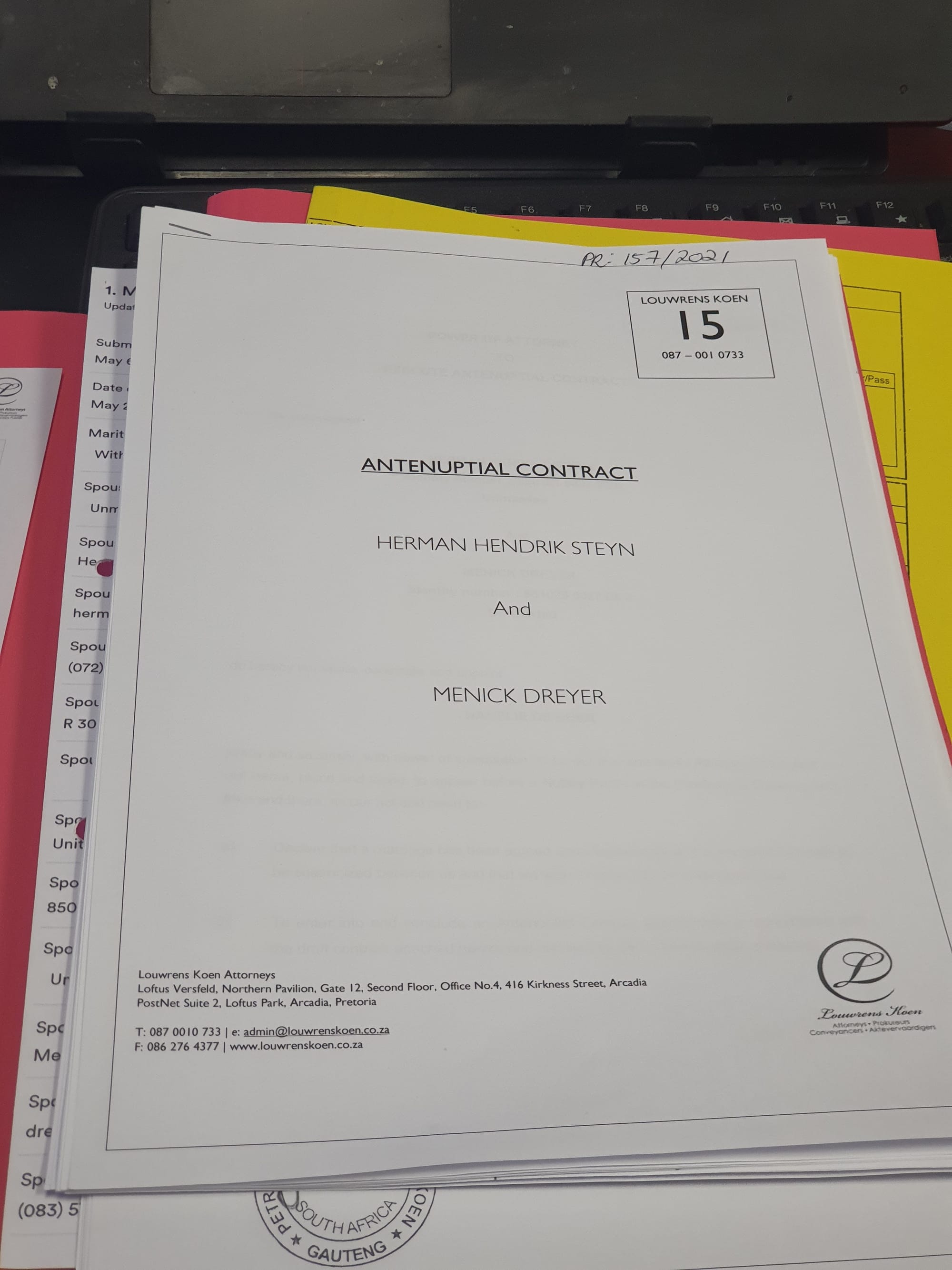

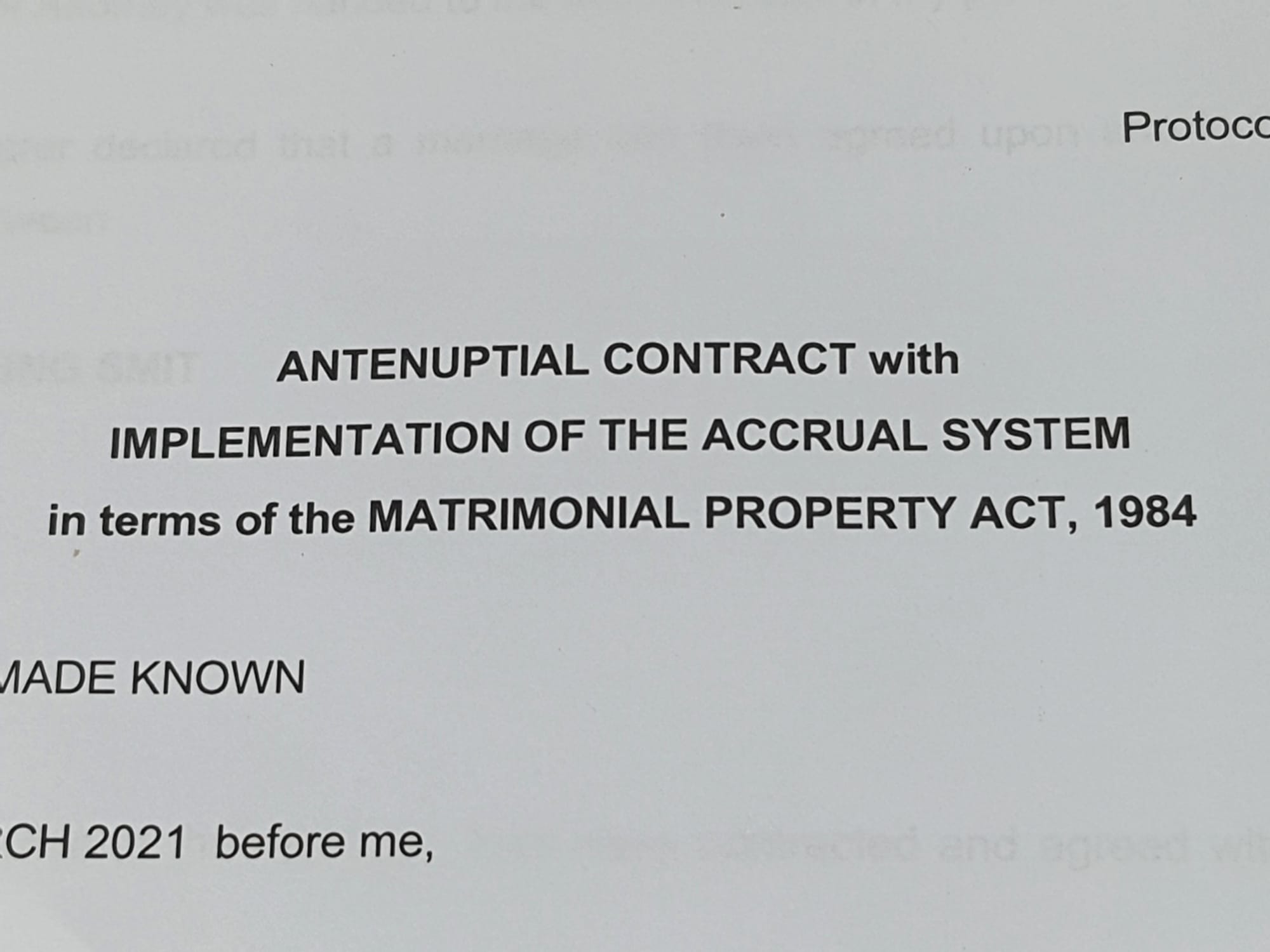

About Our Specialist Antenuptial Contract Services

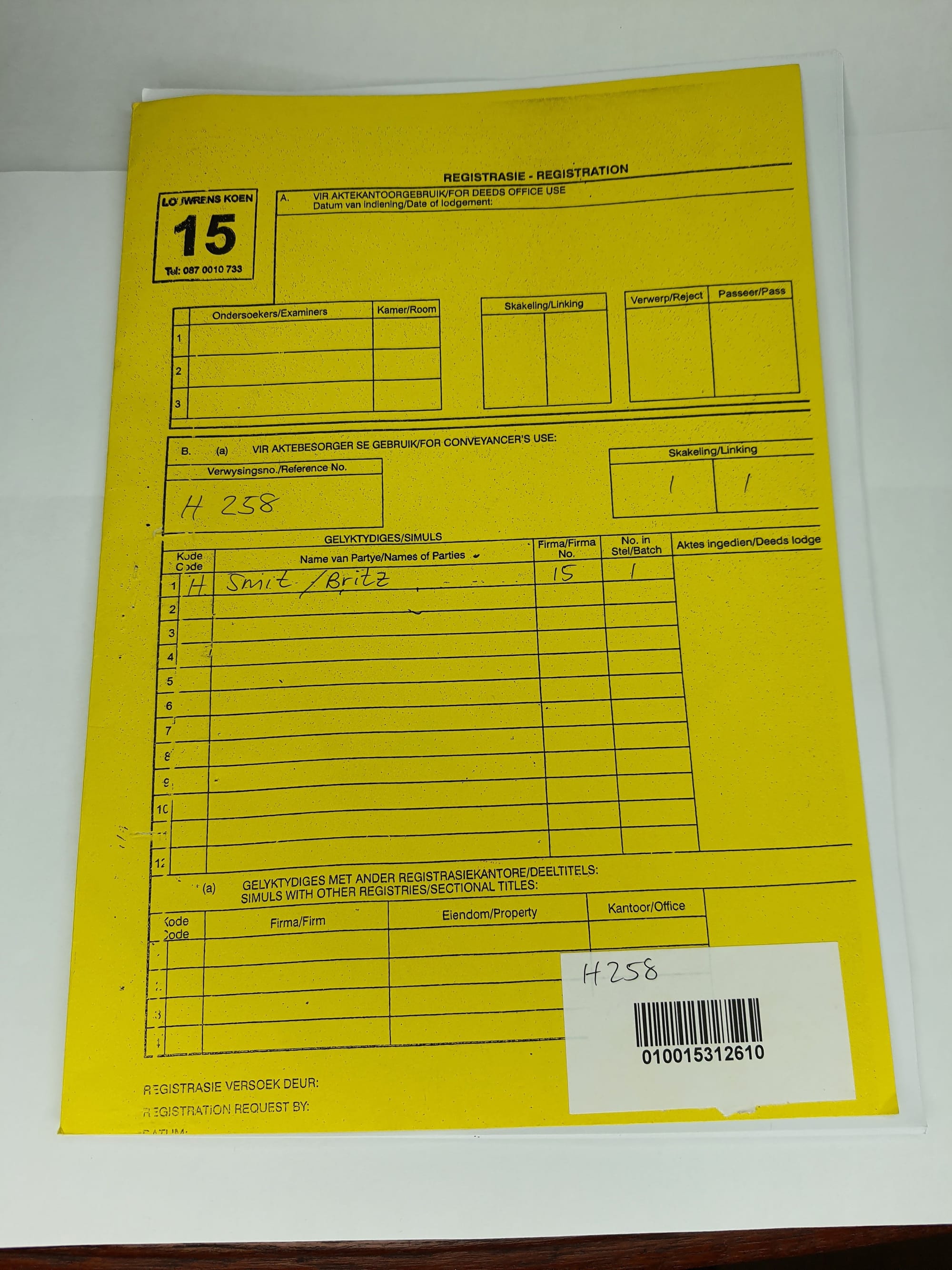

With over 25 years of experience, Louwrens Koen Attorneys is a premier name in South African matrimonial law. We have guided thousands of couples through the vital process of securing their financial futures with expertly drafted and registered Antenuptial Contracts (ANCs).

Why Choose Louwrens Koen Attorneys?

Fixed Fee: R1950 (No hidden costs). Our comprehensive professional fee includes:

Custom drafting of your Antenuptial Contract tailored to your needs.

Why Choose Louwrens Koen Attorneys?

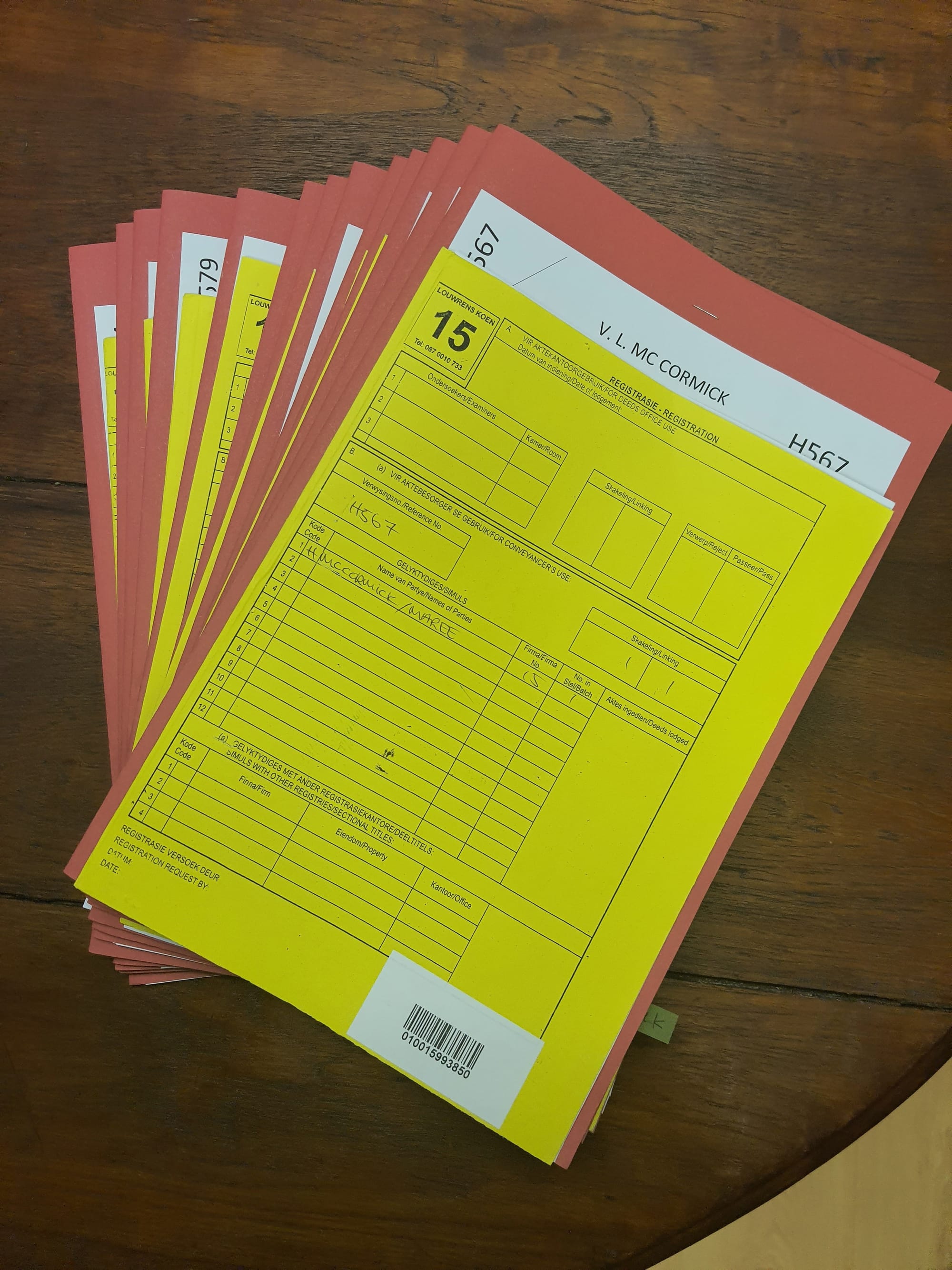

- Expert Notarial Oversight: Unlike generic online template services, we provide full notarial attestation and formal registration, ensuring your contract is legally airtight.

- Efficient Online Intake: Our streamlined Online Application Form allows you to start the process in minutes, from anywhere in South Africa.

- Approachable Expertise: We pride ourselves on being accessible. We translate "legalese" into clear advice you can use.

- Fast Turnaround: We understand wedding timelines. We offer a 24–48 hour drafting service to ensure your legal requirements are met well before you say "I do."

Fixed Fee: R1950 (No hidden costs). Our comprehensive professional fee includes:

Custom drafting of your Antenuptial Contract tailored to your needs.

- Notary Public.

- All Pretoria Deeds Office registration and lodgment fees.

- A formal Letter/Certificate for your Marriage Officer.